The importance of business portfolio analysis is the categorisation of the essential services provided according to their market competitiveness potential and the rate at which sales are incremented and developed.

It is critical to help the growth of a business’s portfolio, which is the sum of all the products and services they provide to the market. When you want to use a certain business strategy, you have to transform your target to a business oriented strategy including budget calculations.

Every business entity is centred around its resources to generate its main source of revenue, so a specified business plan has to be put in motion to meet the needs of the association’s members and targets, this plan is called portfolio analysis.

The portfolio analysis meaning can get complex, however, essentially portfolio analysis helps in the connection of the process of devising a strategy and its execution, aiding the process of budget allocation. Portfolio analysis is the product of Dr. Ian MacMillan of the University of Pennsylvania’s Wharton School.

Table of Contents

Different Types of Portfolio Analysis

Portfolio analysis in business is a crucial aspect of successful investing, allowing investors to assess their investment performance, identify potential risks, and make informed decisions about their asset allocation. There are several key types of portfolio analysis and several portfolio analysis steps, each offering unique insights and benefits:

1. Risk Analysis:

Risk analysis is a critical component of portfolio analysis, as it helps businesses to identify and assess the potential risks that could impact their overall performance. By understanding the risks involved, businesses can make more informed decisions about resource allocation and risk mitigation strategies.

- This type of analysis evaluates the potential risks associated with a portfolio, including:

- Market risk: The risk of losses due to overall market fluctuations.

- Interest rate risk: The risk of losses due to changes in interest rates.

- Liquidity risk: The risk of difficulty or high cost in selling assets quickly.

- Concentration risk: The risk of overexposure to a single asset or sector.

- Risk analysis helps investors identify potential vulnerabilities and implement strategies to mitigate them, such as diversification and portfolio rebalancing.

To effectively analyse risk, businesses should use a combination of qualitative and quantitative methods. Qualitative methods involve collecting and analysing non-numerical data, such as expert opinions and industry trends. Quantitative methods involve using statistical analysis to measure and quantify risk.

Risk analysis can help businesses to:

- Identify and assess potential risks

- Develop risk mitigation strategies

- Make more informed decisions about resource allocation

- Improve overall portfolio performance

- Comply with regulatory requirements

By taking a proactive approach to risk management, businesses can protect themselves from financial losses and ensure that they are well-positioned for success in the long term.

2. Performance Analysis:

Performance analysis helps businesses to assess the effectiveness of their investment strategies and identify areas for improvement. By measuring and analysing key performance indicators (KPIs), businesses can gain insights into the performance of their portfolio and make adjustments as needed.

- This type of analysis evaluates the overall performance of a portfolio over a specific period, considering factors such as:

- Return on investment: The total profit or loss generated by the portfolio.

- Risk-adjusted return: The return earned per unit of risk taken.

- Sharpe Ratio: A measure of risk-adjusted return that compares the portfolio’s return to a risk-free asset.

- Alpha: The excess return generated by the portfolio compared to the market benchmark.

- Performance analysis allows investors to track progress towards investment goals, identify areas for improvement, and compare their portfolio’s performance to benchmarks.

Incorporating performance analysis into portfolio analysis can help businesses to:

- Track and measure portfolio performance

- Identify areas for improvement

- Make adjustments to investment strategy

- Optimise investment returns

- Make better informed investment decisions

By tracking these KPIs over time, businesses can identify trends and patterns in portfolio performance. This information can then be used to make informed decisions about resource allocation, risk management, and investment strategy.

3. Attribution Analysis:

Attribution analysis is a quantitative method used to explain and analyse the performance of a portfolio against a particular benchmark. It helps to identify the sources of excess returns or losses and to understand how these returns are generated.

- This type of analysis identifies the sources of a portfolio’s return or underperformance, looking at:

- Asset allocation: The contribution of different asset classes (e.g., stocks, bonds, real estate) to the overall return.

- Security selection: The performance of individual holdings within the portfolio.

- Manager skill: The impact of the portfolio manager’s decisions on the overall performance.

- Attribution analysis helps investors understand the drivers of their portfolio’s returns and adjust their strategies accordingly.

By regularly conducting attribution analysis, businesses can make informed decisions about their investments and improve their overall financial performance.

4. Portfolio Optimisation:

Portfolio optimisation is the process of finding the optimal allocation of assets in a portfolio to achieve a given level of risk and return. This process involves using mathematical and statistical techniques to identify the combination of assets that will maximise returns while minimising risk.

- This type of analysis uses mathematical models to construct portfolios that meet specific goals and risk tolerance levels, considering factors such as:

- Modern Portfolio Theory (MPT): A framework for building efficient portfolios by minimising risk for a given level of expected return.

- Mean-variance optimisation: A method for constructing portfolios with the highest expected return for a given level of risk.

- Risk parity: A strategy that allocates assets based on their risk contribution rather than their market value.

- Portfolio optimisation helps investors create portfolios that are aligned with their individual needs and preferences, maximising returns while minimising risk.

Incorporating portfolio optimisation into portfolio analysis can help businesses to:

- Improve risk-adjusted returns

- Increase efficiency

- Enhanced diversification

- Improved decision-making

5. Stress Testing:

Stress testing is a crucial component of portfolio analysis, as it assesses the ability of a portfolio to withstand extreme market conditions or adverse events. By exposing the portfolio to simulated scenarios of financial turmoil, stress testing helps to identify potential weaknesses and vulnerabilities.

- This type of analysis evaluates how a portfolio would perform under different hypothetical scenarios, such as:

- Market crashes

- Rising interest rates

- Economic recessions

- Stress testing helps investors identify potential portfolio weaknesses and develop contingency plans to mitigate potential losses.

Incorporating stress testing into portfolio analysis can help businesses to:

- Identify and assess potential risks

- Evaluate the robustness of risk management framework

- Develop contingency plans

- Enhance investor confidence

By regularly conducting stress tests, businesses can proactively manage their risks and protect their financial stability in the face of unforeseen events.

How Exactly Can Business Portfolio Analysis Be Executed?

Most associations have more than one operational business, like publishing, research and development, these branches are called SBUs, short for Strategic Business Units.

Every business has its own products and services. If publishing is taken as an example, the different business verticals could include a journal, specific newsletters targeting different layers of audience segments, a social approach using the internet, and more.

Portfolio analysis helps you to allocate resources more effectively.

For example, you might direct your marketing efforts towards more profitable audience segments.

Let’s take a look at the portfolio analysis advantages and disadvantages as well as the portfolio analysis risk and return.

Portfolio Analysis Benefits

There are several reasons to conduct a portfolio analysis. Key benefits include:

- Prioritising different business verticals.

- Improved decision-making: Portfolio analysis provides businesses with a comprehensive view of their investments, allowing them to identify areas of strength and weakness and make informed decisions about asset allocation, risk management, and investment strategy.

- Enhanced risk management: Portfolio analysis helps businesses to identify and assess potential risks, such as market volatility, credit risk, and operational risk. This information can then be used to develop risk mitigation strategies and protect the business from potential losses.

- Implementing a data-based backbone to the management’s initial plan.

- Improved performance measurement: Portfolio analysis provides businesses with tools to measure and track the performance of their investments, allowing them to identify benchmark against which they are performing and make adjustments to their strategies as needed.

- Budget allocation issues are addressed in terms of the associations goals for growth.

- Increased diversification: Portfolio analysis helps businesses to diversify their investments across different asset classes, sectors, and geographies. This diversification can help to reduce overall risk and improve the stability of the portfolio.

- Improved communication with stakeholders: Portfolio analysis provides businesses with information that can be used to communicate with stakeholders, such as investors, creditors, and regulators. This can help to build trust and confidence in the business.

- Increased value creation: By making better investment decisions and managing risk effectively, businesses can create more value for their stakeholders. This can lead to improved financial performance, increased shareholder returns, and a stronger competitive position.

In summary, portfolio analysis is a powerful tool that can help businesses to achieve their financial goals and protect their long-term success. By regularly conducting portfolio analysis and using the insights gained to inform their investment decisions, businesses can make better use of their resources and generate higher returns.

However, if portfolio analysis isn’t done correctly, there are some potential drawbacks and risks, such as:

- It becomes harder to highlight the market’s sections or layers.

- Oversimplification: Portfolio analysis can sometimes oversimplify the investment process, leading to a narrow view of the potential risks and opportunities that exist. This can be problematic, as it can prevent businesses from taking advantage of complex investment strategies or from mitigating the impact of unforeseen events.

- The subjectivity of the judgment may end up providing a fake scientific impression.

- Weighing the advantages and the disadvantages, portfolio analysis can be considered a systematic approach to the issues of budget and resources allocation.

- Reliance on historical data: Portfolio analysis often relies on historical data to make predictions about future performance. However, historical data may not always be an accurate predictor of future performance, particularly in volatile markets. This can lead to inaccurate assessments of risk and return, which can ultimately damage the performance of the portfolio.

- Difficulty in implementation: Portfolio analysis can be difficult to implement in practice, particularly for businesses with limited resources or expertise. This can lead to inaccurate or incomplete analyses, which can damage the performance of the portfolio.

Recognising the Different Types of Businesses

The first step is recognising the strategic business units that affect the association. To know which groups of business that could become independent.

Typically, there are three different paths that could be taken by the association. The first is core businesses, or the key verticals which have the greatest overall impact.

The second one is support functions, such as legal advice and administrative functions. Vital as these are, they still are not prioritised. Rather the cost of these operations is usually minimised, giving the core businesses some budget leeway.

The third one is any other profitable vertical outside of the core offering.

On paper, core businesses should support themselves financially while also helping with reserves, but that is usually different and it is usually supported with other income that the money making businesses provide, such as insurance and discounts.

Aligning Core Businesses with Objectives

After core business are identified, compare them with your overall mission. A business should work towards the objectives in the mission statement.

If a business vertical doesn’t directly aid the strategic plan, it should be stopped and have its funding and resources go to other core activities.

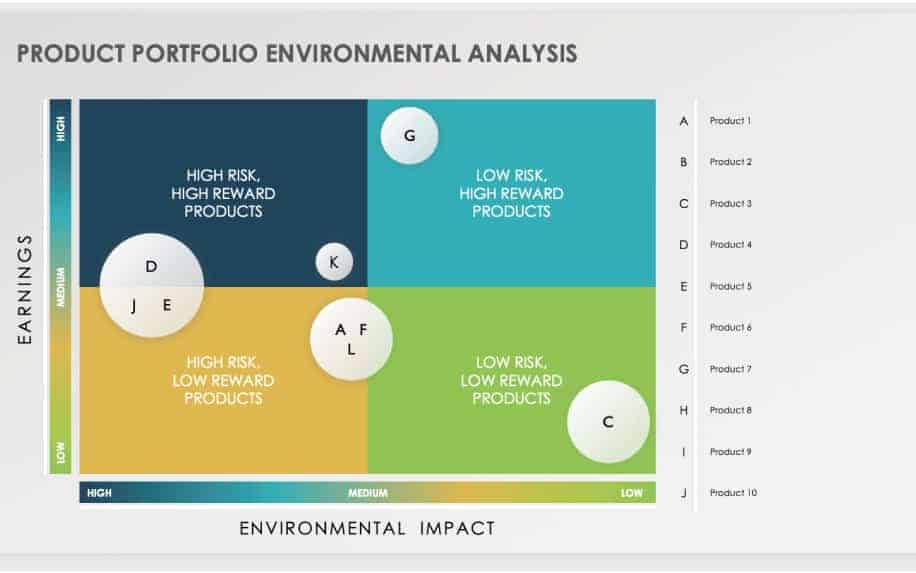

After the value of the businesses is measured relative to the mission statement, the next step is dividing the business into core products and services. These are then entered into the Program Evaluation Matrix.

What is the Program Evaluation Matrix?

It is a visual device that eases the analysis of the products and services in the main portfolio. While the products and services are tested using the Program Evaluation Matrix, a few assumptions have to be made though:

- The allocation of resources is usually competitive, so it is viewed in a competitive environment in the Program Evaluation Matrix.

- The priority is providing optimum service to a small or focused market than a bad one to a bigger market.

- It is only logical economically to leave the bad programs to strong competition and focus on getting the potentially good programs from easier competition.

Assessment of the Business Properties

Program Evaluation Matrix is a very helpful tool in portfolio analysis for providing answers to certain questions about valid questions regarding the products and services in a portfolio:

- Does it align well with the other services?

- Is the implementation process complex or rather simple?

- What is the status of the alternative coverage in the market?

- Do we have a competitive advantage over the market?

The answer should be yes to all these questions for a program or a service to be prioritised in the allocation of resources.

The criteria for the best service depends on it being relevant to the objectives of the business, and highlighting the main concerns that are of high interest to stakeholders and customers.

Funding and Integration

There are some extra criteria for deciding if a product or service deserves more funding, for instance, if it:

- Creates a base of customers that can provide potential support on the short term and long term.

- Provides a constant stream of income.

- Generates demand from a big customer base.

- Attracts a willing and capable leadership.

- Delivers results that can be tracked and measured.

In competitive portfolio analysis, it is found that even organisations that are not profitable are forced to operate in a highly competitive setting, affecting the success of the delivery of core products and services.

The definition of alternative coverage is the availability of a similar product or service with other competitors. The products and services are categorizsd into two different categories:

- Low coverage: Fewer similar products and services are provided by competitors.

- High coverage: A lot of similar products are provided by competitors.

SEE ALSO: Product Management: What It Is and How It’s Done

Program Competitiveness Test

In portfolio analysis, some conditions should be applied to determine if a business vertical is competitive.

All organisations operate in a competitive environment of some kind. They might compete for

- A bigger slice of market share to make sure the market is saturated with the association’s products and services,

- Higher calibre, value and quality than the competing associations,

- Better productions and marketing for the program,

- Maintaining a low cost delivery of products and services,

- Synchronisation of products and services with the potential requirements of the association’s members and customers.

Data-Driven and Scientific Portfolio Analysis

In the past portfolio analysis used to be limited to the space of the corporate Research and Development, and is now being studied in different academic and agency environments.

Choices based on portfolios are not that easy to make in a scientific system, due to the ill-definition and understanding of the actual choices. Some things are simply difficult to quantify. Portfolio options are usually controlled by the assessment of supply and demand.

Supply and demand can actually be of value to the research of portfolio analysis scientifically. Precise definition of the used terms is of high importance because it is easy for them to be defined in different manners.

An Overview of Portfolio Analysis

Portfolio analysis basically is the breaking down a business into different processes and verticals, and analysing the risks, costs and returns of these.

If used regularly, portfolio analysis can help businesses make better decisions and adapt to changing market conditions.

This is essential in resource allocation to different component elements in the portfolio.

Specific Examples of Portfolio Analysis Tools and Methods

1. Risk Analysis:

- Example tool: Morningstar X-Ray Tool (tip: there’s a portfolio analysis free trial with this tool).

- Method:

- Input your portfolio holdings into the tool.

- The tool will calculate various risk metrics, such as standard deviation, beta, and Value at Risk (VaR).

- Analyse the risk profile of your portfolio and compare it to your risk tolerance level.

- Identify high-risk assets and adjust your portfolio allocation to mitigate risk.

2. Performance Analysis:

- Example tool: Google Sheets (portfolio analysis free tool)

- Method:

- Download historical data for your portfolio holdings.

- Calculate key performance metrics like return on investment (ROI), annualised return, Sharpe Ratio, and Alpha.

- Create charts and graphs to visualise your portfolio’s performance over time.

- Compare your portfolio’s performance to relevant benchmarks and identify areas for improvement.

3. Attribution Analysis:

- Example tool: Portfolio123 Asset Allocation Analyzer

- Method:

- Upload your portfolio data to the tool.

- The tool will analyse the contribution of different asset classes and individual securities to your portfolio’s return.

- Identify which assets are driving performance and which are underperforming.

- Adjust your asset allocation or individual holdings based on the attribution analysis.

4. Portfolio Optimization:

- Example tool: Portfolio123 Optimizer

- Method:

- Define your investment goals and risk tolerance level.

- Input your available investment capital and asset preferences.

- The tool will suggest an optimised portfolio based on your inputs and Modern Portfolio Theory principles.

- Review the proposed portfolio and adjust it as needed based on your individual preferences and risk tolerance.

5. Stress Testing:

- Example tool: Portfolio123 Risk Simulator

- Method:

- Input your portfolio holdings and select various stress scenarios.

- The tool will simulate the potential impact of the selected scenarios on your portfolio’s value.

- Analyse the simulated results to identify potential weaknesses in your portfolio.

- Implement risk mitigation strategies, such as diversification and portfolio rebalancing, to improve your portfolio’s resilience to market shocks.

These examples demonstrate how different tools and methods can be used to conduct portfolio analysis. The specific approach you choose will depend on your individual needs and preferences.

Insights and Recommendations based on Portfolio Analysis Results

After conducting portfolio analysis, it’s crucial to draw insights and make informed decisions to optimise your investments. Here are some examples:

Risk Analysis:

- Insight: Your portfolio may be heavily concentrated in a single sector or asset class, leading to exaggerated risk exposure.

- Recommendation: Diversify your portfolio across different sectors and asset classes to reduce concentration risk.

- Insight: You may have a higher risk tolerance than your current portfolio suggests.

- Recommendation: Consider increasing your allocation to higher-risk assets to potentially boost returns.

Performance Analysis:

- Insight: Your portfolio may be underperforming compared to relevant benchmarks.

- Recommendation: Analyse the underperforming holdings and consider replacing them with assets offering better performance potential.

- Insight: You may be incurring excessive fees and expenses that are dragging down your returns.

- Recommendation: Review your investment fees and explore options for reducing them, such as negotiating with your investment manager or switching to low-cost index funds.

Attribution Analysis:

- Insight: A specific asset class is significantly contributing to your portfolio’s return.

- Recommendation: Consider increasing your allocation to this asset class to potentially boost overall returns.

- Insight: Certain individual holdings are underperforming within your portfolio.

- Recommendation: Analyse the reason for underperformance and consider selling these holdings or investing in alternative assets with better prospects.

Portfolio Optimization:

- Insight: Your portfolio may not be aligned with your investment goals and risk tolerance level.

- Recommendation: Rebalance your portfolio to achieve the desired asset allocation and ensure it aligns with your long-term goals.

- Insight: You may be holding too much cash in your portfolio, reducing potential returns.

- Recommendation: Consider investing the excess cash in assets that offer higher returns, considering your risk tolerance.

Stress Testing:

- Insight: Your portfolio may be vulnerable to specific market scenarios, such as a recession or interest rate hike.

- Recommendation: Implement risk mitigation strategies to reduce the impact of these scenarios, such as holding cash reserves or investing in defensive assets.

- Insight: Your portfolio may be more resilient than you initially thought.

- Recommendation: Consider a slightly more aggressive asset allocation to potentially increase potential returns without significantly increasing risk.

Remember, these are just general examples. The specific insights and recommendations you draw will depend on your unique portfolio analysis results and your individual circumstances. Consulting a financial advisor can provide personalised advice tailored to your needs and goals.

FAQs:

Q: What are the benefits of conducting portfolio analysis?

A: Portfolio analysis offers numerous benefits, including:

- Identifying potential risks: Understanding your portfolio’s risk exposure allows you to make informed decisions about risk mitigation strategies.

- Evaluating performance: Tracking your portfolio’s performance helps you identify areas for improvement and compare your progress towards investment goals.

- Gaining insights: Analysing your portfolio’s composition and its performance drivers helps you make informed allocation decisions to optimise returns.

- Improving decision-making: Utilising portfolio analysis tools and methods empowers you to make data-driven investment choices.

Q: How often should I conduct portfolio analysis?

A: The frequency of your portfolio analysis depends on your risk tolerance, investment goals, and market volatility. Generally, it’s recommended to conduct a thorough analysis at least annually and consider more frequent reviews during periods of significant market fluctuations or changes in your personal circumstances.

Q: Which tools and resources are available for portfolio analysis?

A: Several tools and resources can assist with portfolio analysis, including:

- Online financial calculators: Portfolio123, Morningstar X-Ray Tool

- Spreadsheet software: Google Sheets, Microsoft Excel

- Investment management platforms: Fidelity, Vanguard

- Financial advisors: Professional guidance and personalised advice

Q: How do I choose the right portfolio analysis method?

A: The best way to choose the right portfolio analysis method is to consider your company’s specific needs and goals. If your company has a limited number of products or services, the BCG Growth-Share Matrix may be a good option. If your company operates in a complex or volatile market, the GE Business Screen or the McKinsey 9-Box Grid may be a better choice. We recommend that you compile your findings into a portfolio analysis dashboard, enabling you to easily see and read the data.

Q: What are some common mistakes to avoid in portfolio analysis?

A: Avoid these common pitfalls:

- Ignoring risk: Focusing solely on potential returns without considering the associated risks can lead to unexpected losses.

- Over-analysing: Excessive analysis can lead to paralysis by analysis, hindering decisive action.

- Chasing performance: Chasing past performance doesn’t guarantee future success and can lead to poor investment choices.

- Lack of diversification: Concentrating your portfolio in a single asset class or sector exposes you to unnecessary risk.

Q: How often should I analyse my portfolio?

A: The frequency with which you analyse your portfolio depends on the rate of change in your business environment. If your market is changing rapidly, you may need to analyse your portfolio on a quarterly or even monthly basis. If your market is more stable, you may only need to analyse your portfolio on an annual or biannual basis.

Q: Is it necessary to consult a financial advisor for portfolio analysis?

A: While not mandatory, consulting a financial advisor can provide valuable expertise and personalised advice. They can guide you through the analysis process, interpret the results, and recommend strategies aligned with your specific needs and goals.

Key Takeaways

Mastering portfolio analysis empowers you to make informed investment decisions, manage risk effectively, and optimise your investment portfolio for long-term success. By understanding the different types of analysis, utilising available tools and methods, and drawing insights from the results, you can take control of your financial future and achieve your desired investment goals.

Continuous learning, market awareness, and adaptability are crucial to navigating the ever-evolving investment landscape and achieving your financial objectives.