Business risk management is essential for every business. being a key factor to its success. Market competition is at an all-time high. Therefore, it’s more crucial than ever to ensure a safe business plan that provides the highest possible profit.

While all businesses face risk, some can predict and control it, while others can’t.

It’s no secret that risk-taking is a major step towards success. As the saying goes: “Willingness to take risks is the path to success.”

However, uncalculated risk can have damaging consequences.

Therefore, to take those risks, you must have an idea of what they are and how to manage them. Reading this article from start to finish will give you an understanding of business risk management and its different types.

Table of Contents

The definition of Business Risk Management?

Business risk management is the process of identifying and assessing risks along with developing strategies to manage them. Means of measuring and assessing risk depend on the given profession, industry, or business model.

What Is a Risk Management Plan?

A risk management plan and a business impact analysis are fundamental elements of a business strategy. Identifying and understanding potential risks to your business will help provide recovery upon the occurrence of an incident.

Preparing a risk management plan is a common process. However, types of risk may differ according to the type of business. Risk management plans provide detailed methods for dealing with those risks.

Step-By-Step Risk ID Process:

- Gather cross-functional team spanning different business areas.

- Lead brainstorm guided by risk categories – strategic, operational, compliance etc.

- Log all potential risks raised without initial judgement of likelihood or severity.

- Distribute risk survey company-wide to uncover threats teams close to operations see that leaders might miss.

- Feed relevant external data into statistical forecasting models to predict new risks.

- Compile comprehensive list of risks for further qualification.

Risk Analysis With risks identified, analyses help determine where to prioritize based on potential impact and likelihood/probability. Qualitative and quantitative methods each provide value.

Qualitative Risk Analysis

- Score probability, business impact estimators on a 1-5 subjective scale across identified risks.

- Multiply ratings for weighted “risk score”.

- Rank order risks highest to lowest scores. Prioritize those posing greatest threat.

Quantitative Risk Analysis

- Develop statistical models with 3-5 years of internal data to forecast likelihood of risks playing out based on correlations in past losses and risk factors.

- Calculate potential cost impact based on financial damage historical incidents caused.

- Use probabilistic Monte Carlo simulations of worst case losses.

What Is Enterprise Risk Management?

According to the Atlantic International University publication, the concept of “enterprise risk management” was created by risk management professionals. Its purpose was to implement prevention programs and risk awareness on a company-wide basis.

Enterprise risk management seeks to control, identify and assess notably through insurance.

Enterprise risk management focuses on establishing a system of risk management throughout a company in order to handle the risks related to a rapidly changing business environment.

Typically, enterprise risk management includes the following elements:

- Include risk management into the values of the company.

- Support those values with actions.

- Run a risk analysis.

- Implement specific strategies to reduce risk.

- Develop monitoring systems to provide early warnings about potential risks.

- Perform periodic reviews of the program.

Types of Business Risk Management

We must study the different types of business risks and the ways of solving them in order to explain the concept and the importance of business risk management. In addition, we must look into business risk management models and analysis as well.

Specifically, we’ll be looking at the following kinds of risk:

- Strategic,

- Compliance,

- Operational,

- Financial,

- Reputational,

- Political.

Strategic Risk

Strategic risk is a source of loss that might arise from unsuccessful business planning. Hence, your company’s strategy becomes less effective and as a consequence, struggles to meet its goals.

A strategic risk could be a result of changes in customer demand, tough competition, or technological changes.

Xerox became famous for its development of laser printing which was a strategic risk to Xerox’s position. Indeed, it was able to change its business model and adapt to the new technology.

The company survived the strategic risk, and as a result, laser printing became a multi-billion-dollar business. Therefore, if it weren’t for the company’s clear understanding of business risk management, it wouldn’t have sold.

- Define business strategy and objectives: Companies use systems to carry out business plans. However, those systems sometimes fail to address and identify risk. Therefore, it’s extremely important for those systems to identify the business risks during the planning process.

- Construct key performance indicators (KPIs) for result measurement: Your company’s model can vastly improve by utilizing those KPIs. Therefore, overall sales aren’t as valuable as KPIs sales per customer which promotes the need for answers.

- Identify risks that can affect performance

- Construct key risk indicators (KRIs) and tolerance levels for critical risks: KRIs are intended to anticipate potential roadblocks. Meanwhile, tolerance levels serve as triggers for action.

- Monitoring and reporting: Companies have to monitor results and KRIs on a consistent basis in order to reduce risk to a minimum.

Compliance Risk

Managing company compliance to meet law regulations is known as compliance risk management. Certain regulators are known to be aggressive by both lessening compliance investigation timelines and charging higher fines.

Furthermore, non-compliance can cause public embarrassment, bad reputation, and civil lawsuits.

There are four categories that explain the management of compliance risk in business risk management:

- Weak compliance risk management: Form a compliance team to identify compliance needs and requirements, and to assess the existing compliance program.

- Compliance process and technology: Analyze objectives and compliance, and invest in new technology. Technological choices vary from compliant cloud storage for HIPAA, to unified GRC frameworks, to compliance point products such as financial reporting for SOX. There are also System and Organization Controls (SOC) standards which can be used to improve operations and bolster customer trust as a result. Of course understanding the differences between the SOC types is critical to effective compliance.

- Reviewing millions of documents: Some compliance investigations require companies to analyze and review millions of documents within a few weeks. Consider automated compliance workflows which are platforms that save large amounts of money on the review process.

- Avoiding violations: Interrupting possible violations due to non-compliance is a must. Digital communication monitoring analyses suspicious patterns in digital messaging, such as employee texting and email patterns.

Operational Risk

So far, risks stemming from external events have been discussed in business risk management. However, your own company’s also a source of risk.

Operational risk is an unexpected failure in your firm’s daily operations. It could either be a technical failure or a failure caused by people.

Operational risk is anything that interrupts your company’s operations. In some cases, operational risk has more than one cause.

For example, consider the risk of an employee writing the wrong cheque. That’s both a “human” failure and a “process” failure. In some cases, operational risk can also stem from natural events such as a power cut or a natural disaster. To mitigate these risks effectively, organizations often employ an employee monitoring system to enhance process accuracy and prevent costly errors.

Operational problems can also prevent your business from dealing with your customers, resulting in a loss of revenue and damage to your reputation.

Financial Risk

Financial risk refers to money inflow and outflow and the possibility of a sudden financial loss. There’s a spectrum of challenges that businesses face, notably credit, liquidity, and market risks. Credit risk arises from potential defaults on financial obligations by debtors, highlighting the need for stringent credit assessments.

Liquidity risk, on the other hand, pertains to the inability to meet short-term financial obligations, underscoring the importance of maintaining adequate cash reserves.

Market risk involves the uncertainty of financial losses due to market fluctuations, making it crucial for businesses to adopt diversified investment strategies to mitigate potential impacts. In this realm, robust financial planning and astute cash flow management play pivotal roles.

Moreover, the advent of financial technologies (FinTech) has transformed risk management. FinTech solutions, through innovative tools like real-time analytics and automated risk assessment platforms, have empowered businesses to better navigate financial uncertainties

Here are some tips for managing financial risk in business risk management:

- Carry Insurance: Insurance is meant to protect your business from potential losses that you can’t afford to replace.

- Ensure enough emergency funds: Having appropriate emergency funds will be a lifesaver in unexpected situations. It’s central to have a small fund for potential problems, but more important to have a separate saving account in case of a long-term crisis.

- Invest with diversity: Although investing in different businesses won’t ensure a financial safety plan, it will reduce the risk of complete financial failure.

- Have a financial plan B: The best counter for losing your job is to have an alternate job that offers financial security, or a plan to get a new job in a short time span.

- Know the right time to bail on an investment: If you’re smart, you can always control how much you ultimately lose from an investment.

Business Risk Management: How to Manage Risk in Business

Business Risk Management: Identifying the Risk

In business risk management, understanding risk is as important as identifying it. Staff from different backgrounds are best to effectively identify all risks.

Risks that are identified by a certain group of staff can be completely different, but as crucial as other risks that were identified by other groups. Everyone in your company has unique expertise, so they can spot risks that others may miss.

Business Risk Management: Assessing the Risk

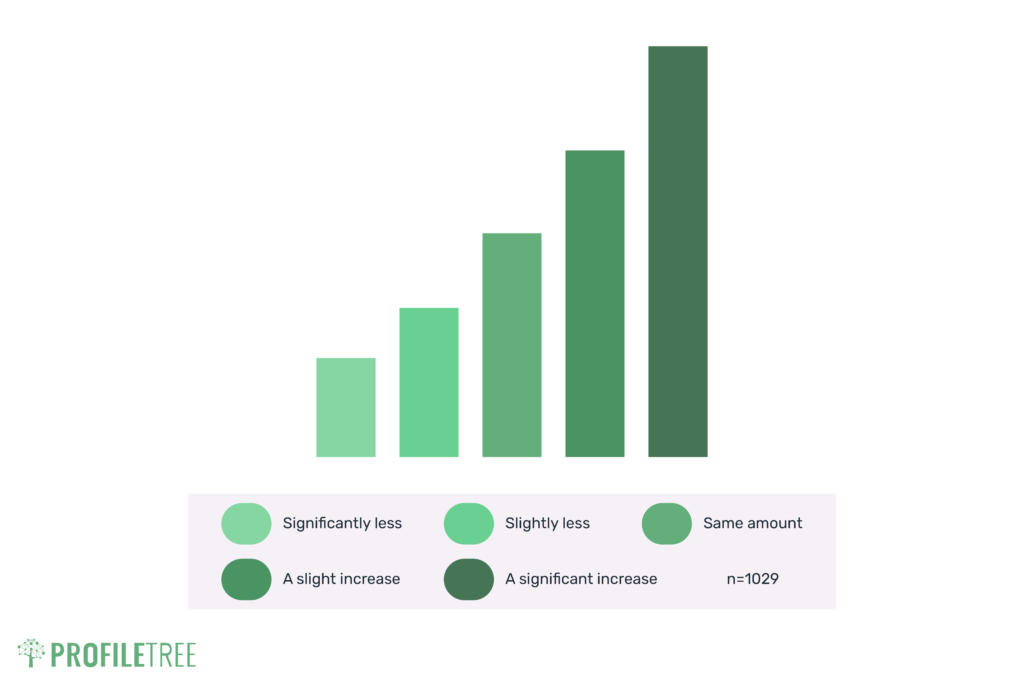

Upon identifying your risks, start assessing them. This will have to carry out both quantitative and qualitative processes. Different factors, such as occurrence frequency, need to be addressed.

Business Risk Management: Measuring and Reducing

Reducing, measuring and possibly defusing your risks is the next step. As that is done, it should minimize your company’s risks and minimize their harm. This often means putting processes in place to eliminate avoidable risks once they have been identified.

Business Risk Management: Monitoring and Reporting

Monitoring and reporting those risks is to ensure how effective the plan is. Most of all, it’s to ensure the effectiveness of your solutions regarding their ability to manage potential risks.

Reputational Risks and How to Manage Them

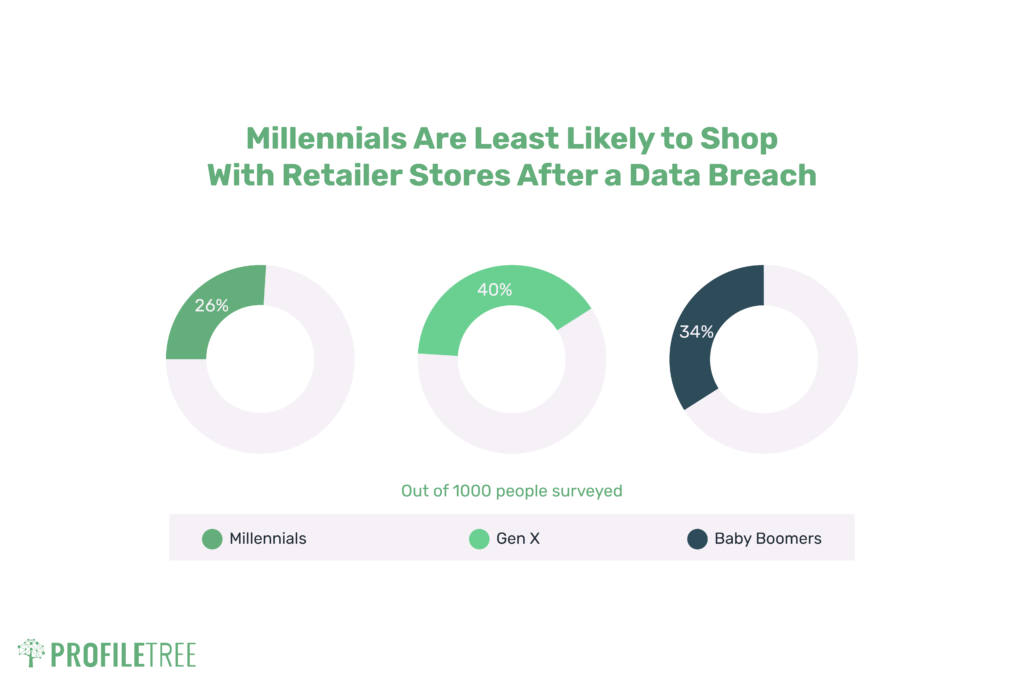

Reputation is everything in business. A damaged reputation can cause a sudden loss of revenue and be a major turn off for customers. Furthermore, a bad reputation can cause staff leaving your business.

In addition, you may find it hard to hire good replacements, as potential applicants may have heard about your bad reputation. Suppliers may start to offer less. Advertisers or sponsors may decide to ditch you.

Here are the steps you can take to eliminate or control reputational risk.

1. Include Reputation Risk as Part of Strategy and Planning

Investigate holes in your business and determine relevant reputation elements within your business. Visualize potential scenarios that could damage public perception. Determine indicators and warnings for each element so that you can know when to take action.

2. Control Processes

When you have firm processes in place, it is much easier to avoid reputational risks. Standardization, technology, policies, and procedures reduce the likelihood and severity of events causing reputation damage.

These days, reputational damage occurs most often through social media. When you have firm processes in place, like a standard tone of voice or a content calendar, this can be easily avoided.

3. Understand that All Actions Can Affect Public Perception

Top management must recognize the importance of reputation risk management, and middle managers must lead by example to promote positive messages to key stakeholders.

Organisational training and procedures can ensure that all employees know how to behave and respond appropriately to any situation.

4. Understand Stakeholder Expectations

When you know what client expectations are, it’s much easier to meet them. Don’t try to set expectations too high by promising offers that you cannot follow-up on. You should also set clear expectations for each stage of project delivery, including what is expected of clients.

5. Focus on a Positive Image and Communication

It’s key to always send out positive messages to the public and to your customers. Over time, this will build up your reputation in the public mind, and by turn, reducing the impact of any damage in the future.

How to Manage Political Risk in International Business

How do you manage political risk in international business? This is a question often asked in business risk management by companies who make a serious mistake when they ignore or underestimate political risk. Political risk can pose significant problems to many companies.

Most companies neither measure nor manage political risk. However, effective management of political risk can enable companies to enter and navigate new markets and business environments, providing a potential for competitive advantage.

Take a look at Forbes’s three-step process for managing political risk in business risk management:

- Identify risks: Risk managers identify the main political risks by geography. The key question at this stage is: “How can political rules affect our goals?” Study political risk types which range from capital controls` to increased taxation, to strikes.

- Measure: Risk managers assess and quantify the potential impact of each scenario on the business. For example, a discounted cash flow analysis can be used to estimate the financial impact of specific events to help companies understand their tolerance levels.

- Manage: The first element in managing political risks is to map potential risk management methods against the priority risks. Once your company sets a course of action, your team can assign duties and set a schedule for consultation, reporting, and review, as with other risk controls.

FAQ Section:

What are the main benefits of business risk management?

Some key benefits include reducing the likelihood of threats materializing through proactive mitigation, minimizing financial losses and disruption when risks do emerge, gaining competitive edge over less prepared peers, and having greater insight to enhance strategic decisions.

When should you conduct enterprise-wide vs project-specific risk assessments?

Conduct enterprise-wide risk assessments annually to gauge top risks across the entire business. Additionally perform targeted risk reviews before major capital projects, new product launches, expansion into new markets etc. to surface specific threats just for new initiatives.

What risk management frameworks like ISO 31000 cover?

Frameworks provide guidelines establishing context, identifying risks, analyzing potential impacts, proper evaluation criteria, effective mitigation tactics, appropriate levels of risk treatment based on severity, and ongoing monitoring of emerging threats.

How much does an automated Business Risk Management Software System cost?

Pricing varies greatly based on number of users, sophistication of probability and impact modeling capabilities, size of historical risk database, integration needs etc. but roughly $10K – $100K+ per year for enterprise solutions.

Conclusion:

Effective business risk management is a strategic imperative rather than a nice-to-have compliance exercise for companies operating in today’s uncertain landscape.

By taking a proactive stance to risk assessment and mitigation planning guided by established frameworks, businesses can enhance their resilience, readiness, and decision making to create sustainable value over the long-term. The insights generated and vigilance instilled through strong risk management capabilities separate the organizations best positioned for prosperity regardless of what threats the future holds.