For the last few years, Bitcoin has certainly been under the spotlight as the “currency of the future”. Bitcoin was created in 2009 in order to create a universal currency that may be used by anyone, everywhere independent of banks. But not everyone knows how to purchase Bitcoin.

This virtual currency gained popularity due to its decentralised nature where transactions occur directly between users.

Its increasing value has generated even more interest in Bitcoin. Before we discuss how to purchase Bitcoin, let’s first take a look at how it works.

Table of Contents

What Is Bitcoin?

The idea of a peer to peer cryptocurrency was created by Satoshi Nakamoto’s paper which detailed the intricacies of a digital currency that is independent of a central entity.

The first block was mined on the 3rd of January 2009 which was called “The genesis block”. The reward for finishing that block was 50 Bitcoins and thus began the Bitcoin network.

A fun fact about Bitcoin is that it was first used to purchase two pizzas for the low price of 10,000 BTC. Today, that amount of coins is worth a whopping £56 million.

What Is a Cryptocurrency?

A cryptocurrency is a secure digital property that has a real-world value through its exchange. It is basically a form of electronic money that is decentralised to ensure security.

Transactions occur between two users. Instead of being processed in a central bank, the transaction is verified by a massive network of users known as a blockchain.

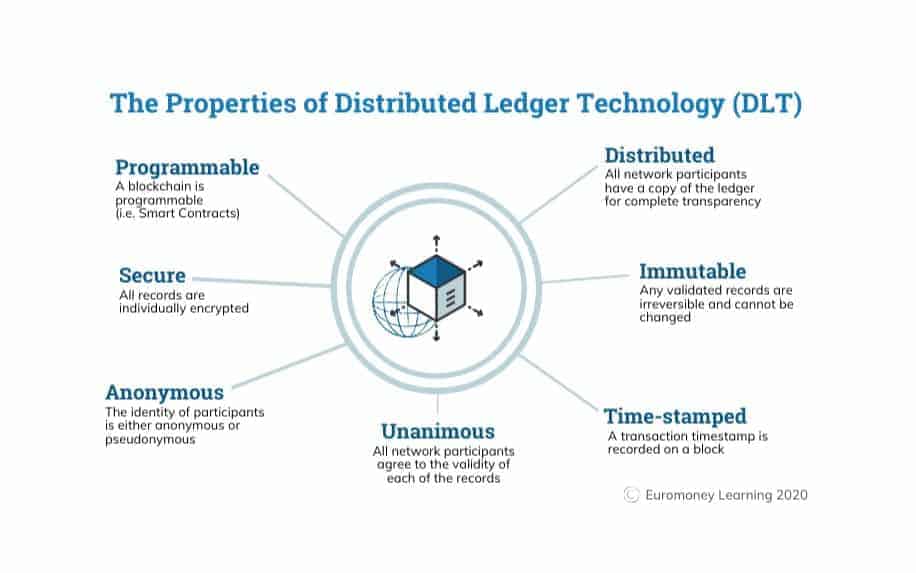

What Are Blockchains?

The term blockchain describes a massive network of users that have opted to lend their computer’s computing power to process transactions in exchange for a small transaction fee.

These blocks act as a “record” of all the transactions that have been made. Once a block is full, a new block is created which provides another opportunity to earn Bitcoins.

Where Do Bitcoins Come From?

behind blockchain has unlocked a wave of new innovative projects.

Credit: Taylor Vick

Mining is the process by which Bitcoins are generated. This process involves the users lending their processing power to the blockchain for a chance to earn a fraction of the generated coin.

Mining involves your processor generating a random number and checking it against the current block “puzzle”. There can only be one “right answer” for each block and that person is rewarded with a predetermined reward for the block.

This is an extremely competitive process that is automatically regulated by the algorithm to ensure that inflation does not occur. A known number of Bitcoins are generated every year and that amount is halved the next year until there are 21 million Bitcoins generated.

This creates a bottleneck in the supply which ensures that the currency does not devalue itself through the excessive generation of Bitcoin.

The flip side is that, unlike traditional currencies, there is a finite number of Bitcoins. This means that with increased interest in the currency, prices have skyrocketed.

Advantages of Using Bitcoin

Purchasing Bitcoin opens up a range of benefits. As an emerging technology, Bitcoin allows you to do a number of things which you can’t always do with traditional currencies.

Here are some of the major advantages of using Bitcoin.

Universal Currency

Due to the digital nature of Bitcoin, all you need to make a transaction is an internet connection. This will allow you to send or receive payments across the globe without having to worry about exchange rates or extra fees.

Additionally, the decentralised nature of Bitcoin ensures that transactions can be made at any time regardless of bank holidays since there is practically no downtime.

Security

Since there is no organization regulating Bitcoin, it is not possible to track a person’s transaction since it is exclusively between two users. Likewise, there is no risk of identity theft or interception of your hard-earned money.

Reliability

The process of verification of a transaction is done through a complicated cryptographical process which ensures that no fraud can occur and you can be sure that the money you received cannot be charged back or manipulated.

Efficiency

Since the transactions are handled by a network of users instead of dedicated servers, transaction fees are extremely low especially when compared to other online mediums of transactions.

For comparison, PayPal requires a 3.4% transaction fee when you try to send money via credit card while Bitcoin transaction fees can be as low as £0.14 (flat fee). To check the current Bitcoin transaction fees, check out Bitcoinfees.info.

All of this makes Bitcoin an extremely appealing option for online vendors since they don’t have to worry about fraudulent transactions, chargebacks or changes in legislation which might increase their bank fees which ultimately cuts into their profits.

However, Bitcoin is far from the perfect solution, it does have its problems as we’ll see in the next section.

Disadvantages of Using Bitcoin

Of course, there are many downsides to using Bitcoin. As with any new technology, there are always going to be teething problems. Additionally, since Bitcoin is not exactly the mainstream, there are a number of instances where it doesn’t stand up to traditional currencies.

Fluctuations

Cryptocurrencies are far from being perfect, as they are still being improved to ensure their stability. This means that there’s an inherent risk of devaluing due to people moving from one cryptocurrency to the other.

Since Bitcoin is a currency that is not based on a physical value the popularity of a certain cryptocurrency heavily affects the demand for it and consequently the price.

A recent example of this was the recent “hard fork” which essentially means that a new algorithm for calculating blocks is released which forces miners to either remain with the old algorithm or move onto the new one.

This results in either the previous or the new fork being more popular and thus more expensive. If you’d like to learn more about the various forks that had occurred over the years, check out this article on the history of Bitcoin forks.

Inherent Deflation

Due to the pre-programmed “scarcity” of Bitcoins, it is reasonable to expect that the value of Bitcoin will deflate once it reaches its 21 million coins generated. This limited supply favors early adopters of the cryptocurrency.

Additionally, many have theorized that this pre-programmed deflation may lead to the collapse of the currency due to users holding onto their coins until they become more valuable.

This is known as the “Deflationary spiral” which argues that a deflating currency may hold too much “future value” causing its users to refrain from spending it until it simply dies out.

Some argue that it is not applicable in theory to Bitcoin since there is no preset deflation value that can be predicted. However, the current decline of Bitcoin can partly be attributed to the increased retention of Bitcoin as many speculated that it was going to significantly increase in price.

How to Purchase Bitcoin

Before you learn how to purchase Bitcoin, it is important to first understand how it is stored. Unlike traditional currency, Bitcoin is not a physical object that may be exchanged. It is an electronic currency that is securely stored in your electronic wallet. Some residents research options to buy Bitcoin Australia through regulated local crypto trading platforms and exchanges – though risks remain given the volatility.

What Is an Electronic Wallet?

A Bitcoin wallet is a piece of software that securely stores the “address” where your owned Bitcoin can be found. The Bitcoin itself does not exist in your wallet but it points to where it is located on the network.

It is extremely important to ensure that your wallet is secure because that is the weakest link when it comes to getting stolen. This is achieved by your wallet creating 2 keys, a public and a private one.

Your public key can be used to send or receive Bitcoins while your private key remains inside of the wallet to ensure that only the person in possession of this key can access the wallet.

This might seem like it requires advanced tech skills but fortunately for us, there exist several free wallets that have built up quite the reputation for being reliable and trustworthy. Here are some of these wallets to help you have a streamlined Bitcoin handling experience.

Online Wallets

Technically, these are not wallets but websites that offer you the service of holding your Bitcoins for you.

That means that you don’t have to worry about backing up your wallet but it comes at a cost since these sites usually take an extra fee for handling your Bitcoin transactions. If you’re like an effortless experience, these are your go-to sites.

However, they are not recommended for larger quantities of Bitcoin since you’ll be losing on a lot of money through fees.

BlockChain

This website provides their users with a free online wallet where they may “hold” their Bitcoins.

In addition to being a wallet, they also provide various valuable statistics regarding Bitcoins such as the latest finished blocks, the number of transactions made and the current exchange rate for Bitcoin.

This is a great website for beginners since it’ll keep you up to date with the latest Bitcoin news.

Offline Wallets

This type of wallet stores the Bitcoin-related data on your device. This requires you to install a software that manages said data.

This is a safer alternative to online wallets because the data only exists on your computer instead of being stored on a server, however, since the data is exclusively stored on your computer, you run the risk of losing all your Bitcoins if you lose access to your computer.

Here are some of the best wallet software available.

Exodus

This software wallet will not only store your Bitcoin data but it will also allow you to manage multiple wallets, store other cryptocurrencies and even provide you with valuable statistics regarding your relevant cryptocurrencies.

This professionally made tool is highly customizable where you can choose from various themes that better suit your style while also displaying informative charts regarding your current balance.

This software is available for Windows, Mac, and Linux which makes it one of the most popularly used tools for cryptocurrencies.

Electrum

This particular wallet is known for being one of the oldest software wallets available. This wallet has an added feature of allowing you to recover your wallet using a “secret phrase” that you set up when you create your wallet.

In addition to being compatible with Windows, Mac, and Linux, Electrum is also available on Android for your on-the-go Bitcoin endeavors.

Bitpay

This easy to use wallet was made to simplify the process of using Bitcoins for the consumer. Not only does it have a simple user interface, but it also allows users to convert their Bitcoins into real money.

Several businesses have started accepting Bitcoin payments via Bitpay such as Zynga, Newegg, and Virgin.

It is also available on almost all devices which has significantly helped in the spread of Bitcoin among non-tech savvy individuals, further establishing Bitcoin as the go-to cryptocurrency.

Physical Wallets

These wallets are miniature devices loaded with a wallet software in order to enhance the reliability of the wallet while also adding an extra step of security.

These are often small devices that you can keep on yourself in order to be able to access your wallet on any device you want while being sure that your data is safe and secure since they never leave the device.

Ledger Nano

This device is the go-to for hardware wallets. It was created by a French company that aimed to create a compact device that supports several of the popular cryptocurrencies such as Bitcoin, Ethereum, and Altcoins.

This USB device adds an extra layer of security to your transactions since it must be connected to the computer and a physical confirmation on the device itself must be made before any transaction is made.

This would eliminate any chances of hackers or computer hijackers from taking over your computer to get to your hard earned Bitcoins.

Trezor

This is another compact hardware wallet that will keep your Bitcoins safe. It supports the various Bitcoin forks in addition to Litecoin, Dash, Zcash, and Ethereum. Their software also generates a 12 to 24 word recovery seed that may be used to recover your coins in case you lose the device.

Now that you have set-up your Bitcoin wallet, it’s now time to learn how to purchase Bitcoin.

Best Methods for Buying Bitcoin

Thanks to the increasing popularity of Bitcoin, it is now extremely easy to acquire some. Here are some of the best methods for buying Bitcoin.

Bitcoin Exchange

These services allow you to buy various currencies using your credit card online. However, it is important to note that buying Bitcoins with your credit card is usually more expensive since the vendor has to go through more risks such as credit card fraud and chargebacks.

Here are some of the most popular Bitcoin exchange websites.

- Coinbase: not only is it an exchange for digital currency, Coinbase also offers their customers a free wallet to store their purchased coins.

- SpectroCoin: in addition to being a digital exchange, SpectroCoin offers their customers a prepaid card which can be used in any ATM or shop worldwide just like a real credit card.

Moreover, when entrusting your hard-earned funds to a cryptocurrency exchange, it’s crucial to evaluate the level of customer support they provide. A reputable exchange should offer a dedicated team of knowledgeable and responsive professionals, ready to guide you through any questions or concerns that may arise during your trading experience. By prioritizing exchanges with exceptional customer support, you can trade with confidence, knowing that assistance is always just a click or call away.

Direct Trading

Sometimes what you need to be asking is “How to purchase Bitcoin cheaply?” and our answer to you is to eliminate the middleman to minimize fees. This means that you should be buying Bitcoins directly from individuals.

However, you have to keep in mind that there’s an inherent risk with dealing with individuals because you cannot guarantee their honesty especially when it’s over the internet.

Luckily, there are some tools that facilitate the trading of cryptocurrencies by setting up permanent profiles for each person to discourage scamming.

Bisq will allow you to start trading Bitcoins in as little as ten minutes. All you need to do is download their app, create a profile with your desired currency and you’ll have access to thousands of orders that’ll suit you whether you are buying or selling.

Bitcoin Exchanges: Pros and Cons

| Exchange Type | Pros | Cons |

|---|---|---|

| Centralized Exchanges (CEXs) | * User-friendly interface * High liquidity * Diverse currency options * Fiat on-ramp (buy with USD/EUR) * Strong security features | * Higher fees (trading, withdrawal) * KYC/AML verification required * Risk of exchange hacks * Less control over private keys |

| Decentralized Exchanges (DEXs) | * Anonymity (no KYC/AML) * No central point of failure * Potentially lower fees * Direct control over private keys | * Complex user interface * Lower liquidity * Limited fiat on-ramp options * Higher risk of technical issues |

| Brokers | * Simple purchase process within familiar platform * May offer educational resources * Some offer fractional shares of Bitcoin | * Limited features compared to CEXs * Higher spreads (hidden fees) * Not ideal for active trading |

Bitcoin Wallets: Pros and Cons

| Wallet Type | Pros | Cons |

|---|---|---|

| Hardware Wallets | * Cold storage (offline) for maximum security * Durable and tamper-proof * Ideal for large holdings | * More expensive than software wallets * Less convenient for everyday use * Risk of physical loss |

| Software Wallets | * Free or low cost * Convenient for everyday use * Multiple device compatibility * Some offer additional features like staking | * Less secure than hardware wallets * Vulnerable to malware and hacking * Not ideal for large holdings |

| Paper Wallets | * Very secure (offline) * Free and easy to create * Convenient for long-term storage | * Prone to physical damage and loss * Difficult to recover if lost * Not suitable for frequent transactions |

Additional Notes:

- The best exchange and wallet for you will depend on your individual needs and priorities. Consider factors like your experience level, investment size, and trading frequency.

- Always do your own research before choosing an exchange or wallet. Read reviews, compare features, and look for reputable recommendations.

- Security is paramount, so prioritize wallets and exchanges with strong security measures.

FAQ

Q: I’m new to crypto – is it too late to buy Bitcoin?

A: While Bitcoin has experienced significant price declines from its 2021 peak, the cryptocurrency market is still evolving. Many experts believe Bitcoin has long-term potential, and 2023 has seen signs of stabilization and rising adoption. However, the market remains volatile, so invest cautiously and only with an amount you’re comfortable losing.

Q: What are the risks of buying Bitcoin?

A: Bitcoin is volatile, meaning its price can fluctuate dramatically. There’s also no guarantee of future returns, and the overall cryptocurrency market is still young and faces regulatory uncertainties. Additionally, scams and hacks are potential risks. Always invest responsibly, research thoroughly, and prioritize secure storage solutions.

Q: How much should I invest in Bitcoin?

A: Treat Bitcoin as a high-risk investment and only invest what you can afford to lose. Experts recommend allocating a small percentage of your overall portfolio to Bitcoin, typically 1-5%, and diversifying your investments across different asset classes.

Q: What resources can I use to learn more about Bitcoin?

A: Numerous resources are available to educate yourself about Bitcoin and the broader cryptocurrency landscape. Popular options include news websites like CoinDesk and Cointelegraph, educational platforms like Binance Academy and Coinbase Learn, and informative podcasts like “The Bitcoin Magazine Podcast” and “Up Only.”

Q: Is there any legal risk to buying Bitcoin?

A: The legal landscape surrounding Bitcoin and cryptocurrencies varies globally. Be sure to research the regulations in your region to understand any potential legal implications of buying or using Bitcoin.

Purchase Bitcoin Overview

Entering the world of Bitcoin can be exciting, but it’s crucial to approach it with knowledge and caution. This guide equips you with the necessary information to navigate the purchase process, choose the right platform, and prioritize security for your Bitcoin holdings. Remember, research, responsible investment, and diversification are key to maximizing your potential success in this dynamic and evolving market.

With the right guidance and a healthy dose of caution, you can embark on your Bitcoin journey with confidence and excitement. Good luck!

Bitcoin is a cryptocurrency that has recently gained a lot of popularity. Unlike traditional physical currencies, Bitcoin is decentralized and relies on its network of users to process and verify transactions.

As a currency that is not linked to a physical precious item of value, Bitcoin derives its value from the supply and demand created by users. We’ve discussed the nature of cryptocurrencies, how to set up electronic wallets and how to purchase bitcoin.

For more financial advice, be sure to check out our article on Financial Management.