Company insurance is what protects a company from any losses or damage caused during the regular course of business whether it is related to damaged property, legal risks or employee-related accidents.

Say you run a shipping company. The truck transporting the goods from point A to point B gets into a car accident. The driver’s injured, the goods are destroyed and the shipment is delayed.

Having company insurance saves you from the financial impact of this.

There are several types of insurance specified for each aspect of business including property, legal liabilities and the security of employees. Companies then assess their need for company insurance based on the risks associated with their usual business activities.

Knowing that whatever life throws at you, you will not be suffering from debt and will not be severely struggling financially is the way to go about it. While paying for company insurance may be pricey, it often works out more expensive to ignore it.

If you wish for your business to survive in the long run, insurance will help make that happen.

Table of Contents

Purchasing Company Insurance: Identifying and Evaluating Risks

Every day, your business deals with different kinds of risks. A risk profile is an assessment of which risks a company faces, and what impact they could have. This informs the decision making of the company as well as investors.

Insurance companies will also take this into account when creating quotes.

The severity of the risks your company is exposed to will determine the type of company insurance you need to focus on, and the level of insurance you need. To assess the risk severity, keep two things in mind:

- Your risk probability – the likelihood of a risk occurring,

- Your risk impact – the impact this risk would have.

You can mathematically calculate these factors separately. The product of the risk impact and the risk probability will give you the risk severity. You can then use this to acquire the appropriate company insurance.

What are the Different Types of Company Insurance?

The insurance you purchase for your company can be split up into different categories to protect different aspects of your business operations.

Company insurance should protect you and your earnings from damages to your equipment, products or employees. Investing in various company insurance types will not come as a loss in the long run.

Here are some of the key types of company insurance you should consider:

- General Liability Insurance: this type of insurance is essential and it protects the company from any physical or property damage.

- Property Insurance: if you own the office or building you work from, or have any personal property in the building property company insurance will ensure your protection in the case of a fire, vandalism, smoke or theft.

- Commercial Auto Insurance: this type of insurance protects your vehicles and automobiles.

- Worker’s Compensation: Workers compensation protects workers who are injured while on the job.

- Professional Liability Insurance: also known as Errors and Omissions Insurance, this type of company insurance will protect your company against damages for the failure of other professional firms.

- Product Liability Insurance: if your business takes part in the manufacturing of a product, product liability insurance is extremely essential. This type of insurance will protect you from cases against you for an incident caused by your product.

- Business Interruption Insurance: if your business were to be interrupted by any sort of uncontrollable event like natural disasters, you need a way to make up for lost time.

How Much Does Company Insurance Cost?

Now that you know you need company insurance, you’re probably wondering how much this is going to cost you. To answer that question, you need to take into account the type of business you run and the risk probability and severity.

Given that you’re aware of the different types of company insurance, you will probably need more than one separately. However, sometimes these insurance policies will be packed into a business owner’s policy.

Company insurance policies change from a business to the next, so your company insurance will be tailored specially to you and the nature of your business operations.

For example, some businesses will require more worker’s compensation instead of commercial auto insurance, some might need higher property insurance. This all depends on the risks in each aspect of your business and the likelihood of it occurring.

The type of company insurance you select for your business will also vary from location to another.

In areas where the likelihood were extreme weather conditions such as snow or sand storms will affect your daily course of action, you might rely on business interruption insurance.

In terms of finance, there is really no average cost for company insurance because of the different variations of it. Yet, whether you are a large or small business, we can estimate some numbers.

For small businesses, you might need to pay £500-£1000 per year for general liability insurance, as your business gets larger that number may increase up to £15,000 per year.

If your business involves a lot of physical labour by your employees, that increases the probability of risk; consequently, your price for company insurance per year will increase.

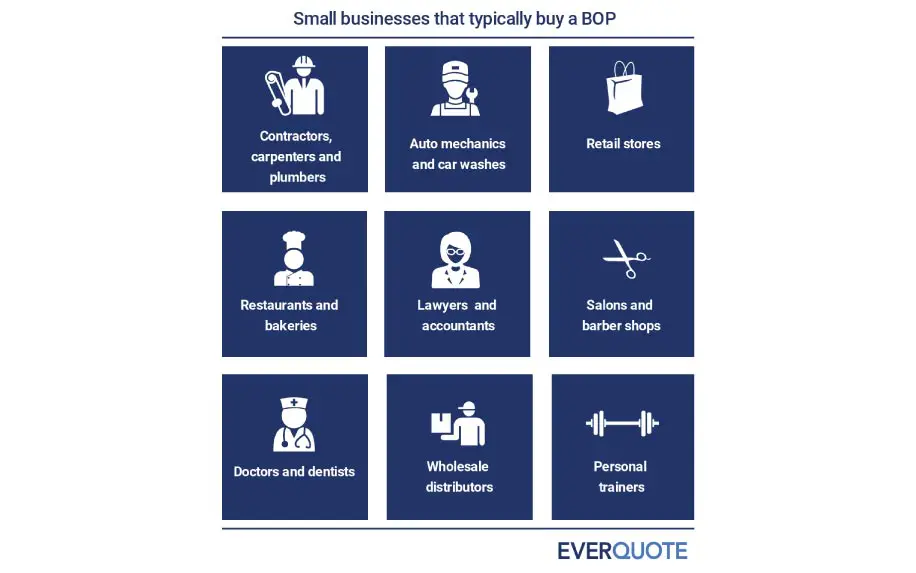

Company Insurance: Business Owner’s Packages

A Business Owner’s Package combines several types of insurance coverages into one single payment. BOPs usually include property damage insurance, general liability insurance, medical insurance, cyber liability and others.

The price of a BOP varies depending on the coverage utilised and the aspects of the business being protected.

A typical BOP could range from £500 to £3500 per year.

But do keep in mind that the pricing of it would probably be less than buying multiple insurance policies separately. Having a BOP is ideal if you own and run a small to medium-sized business, as it provides the basic types of company insurance. Insurance for home health care is an important consideration, especially in the healthcare sector.

In fact, there are some characteristics that your business should have to be eligible for a BOP.

The requirements for eligibility vary from each BOP providers, but generally these are some of the characteristics that are usually considered:

- Class of business (small to medium businesses),

- Location of business operations,

- Size of business’s primary location,

- Revenue.

You will still need separate insurance policies to cover the safety of your vehicles and your employees, as BOPs do not typically include:

- Professional liability,

- Auto insurance,

- Worker’s compensation,

- Health and disability insurance.

Nationwide is one of the world’s leading insurance providers. Using the BOP from Nationwide as an example, you can take a look at what BOPs usually include and the specifics of the package.

Their BOP includes:

- Property damage insurance,

- General liability insurance,

- Personal and advertising injury insurance,

- Bodily injury and medical payments insurance,

- Others property damage insurance,

- Business interruption insurance.

Their additional coverage options include:

- Professional liability insurance,

- Cyber liability insurance,

- Employment practices insurance,

- Accounts receivable insurance,

- Other.

Nationwide also has industry specific BOPs, for example:

- Auto BOP: for auto service businesses,

- Retail BOP: for retail stores,

- Food BOP: for food service establishments,

- Service BOP: for business that perform services,

- Office BOP: for businesses with owned or leased office space.

The Middlemen: Insurance Agents

Whether you own a large corporation or a small business, it’s important to utilise the skills and knowledge of someone who’s actively in the insurance market.

Insurance agents will help you find the best deals and make the best decisions for the sake of your business’ long term survival.

An insurance agent will assess your risk management and apply the most effective and beneficial cost saving strategies to protect your business. They will provide you with a package that ensures all the types of insurance you will need.

Instead of having to visit a range of insurance companies and assess prices, deals and trustworthiness, an insurance agent will get that job done for you.

Sure, here is some content that you can use to improve your article on company insurance:

Different types of company insurance

There are many different types of company insurance available, each of which provides coverage for specific types of risks. Some of the most common types of company insurance include:

- General liability insurance: This type of insurance covers businesses from financial losses arising from bodily injury or property damage caused to third parties.

- Professional liability insurance: This type of insurance covers businesses from financial losses arising from claims of negligence or malpractice.

- Workers’ compensation insurance: This type of insurance provides benefits to employees who are injured or become ill on the job.

- Property insurance: This type of insurance covers businesses from financial losses arising from damage to their property, such as buildings, equipment, and inventory.

- Business interruption insurance: This type of insurance covers businesses from financial losses incurred as a result of a business interruption, such as a fire or natural disaster.

In addition to these common types of insurance, there are many other types of company insurance available, such as cyber liability insurance, product liability insurance, and directors’ and officers’ insurance. The best type of insurance for a particular business will depend on the specific risks that the business faces.

Benefits of company insurance

Company insurance provides a number of important benefits to businesses, including:

- Financial protection: Company insurance can help businesses to avoid financial ruin in the event of a major loss. For example, if a business is sued for negligence, general liability insurance can help to pay the cost of the lawsuit and any damages that are awarded.

- Peace of mind: Company insurance can give businesses peace of mind knowing that they are protected from a variety of risks. This can allow businesses to focus on running their business without having to worry about the potential for financial losses.

- Compliance with laws and regulations: Many state and federal laws require businesses to carry certain types of insurance, such as workers’ compensation insurance. Company insurance can help businesses to comply with these laws and regulations.

- Attract and retain top talent: Employees are more likely to work for businesses that offer comprehensive insurance benefits. Company insurance can help businesses to attract and retain top talent.

How to choose the right company insurance policy

When choosing a company insurance policy, it is important to consider the following factors:

- The size of the business: The size of the business will determine the amount of coverage that is needed.

- The types of risks the business faces: The types of risks that the business faces will determine the types of insurance that are needed.

- The budget of the business: The cost of insurance will vary depending on the type of insurance and the amount of coverage that is needed.

It is also important to compare quotes from different insurance companies before choosing a policy. This can help to ensure that the business is getting the best possible price for the coverage that it needs.

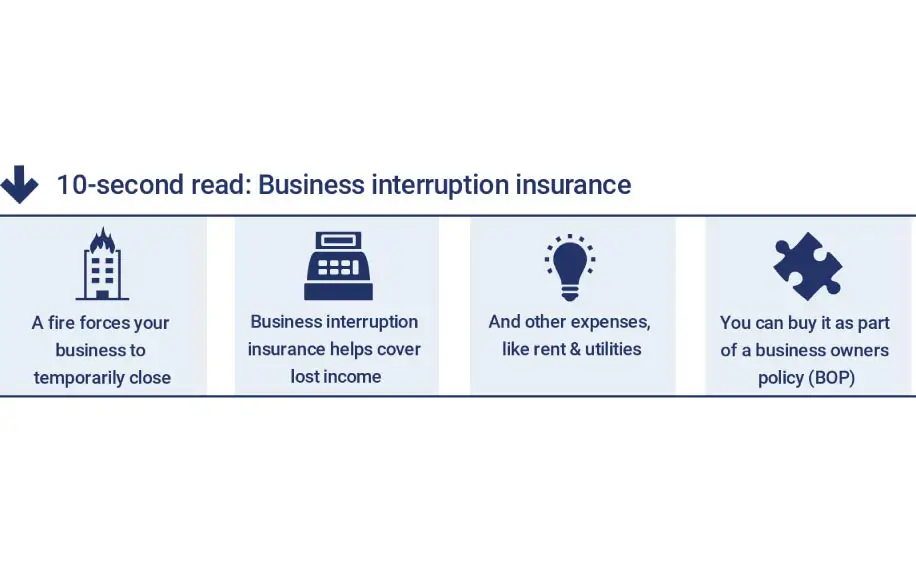

More about Business Interruption Insurance

As a business owner, you want to make the most out of your business all the time.

You’re going to invest all your time and effort to make sure everything runs smoothly, you can take control over your machines, and enforce rules on your employees, but you can’t change the weather, literally.

Sometimes, natural events occur and stop your usual business operations. If not weather conditions, it may be any unexpected event that disrupts your business flow.

There is a special type of company insurance that caters to the losses you face when events as such occur.

The reason behind these losses is because, no matter what happens you are still expected to pay employee salaries and office rents. But how are you to come up with the money to compensate for it?

That is the job of business interruption insurance.

Business interruption insurance is a type of company insurance that pays for your business expenses, when you are unable to due to an unexpected event.

Instead of having to pause your business, this type of company insurance will allow you to keep operating your business by paying for things such as:

- Rent and utilities,

- Moving locations temporarily,

- Lost revenue,

- Repair expenses,

- Advertising,

- Salaries,

- Health insurance.

Business interruption insurance will protect you from unexpected events, but not all. There are some exclusions from the insurance policy such as:

- Flooding,

- Fire,

- Theft,

- Vandalism,

- Glass Breakage,

- Utility Interruption.

Of course, business interruption insurance was a lifeline to countless companies following the outbreak of COVID-19 in 2020.

Business interruption insurance will protect you from unexpected events, but not all. There are some exclusions from the insurance policy such as:

- Flooding,

- Fire,

- Theft,

- Vandalism,

- Glass Breakage,

- Utility Interruption.

Of course, business interruption insurance was a lifeline to countless companies following the outbreak of COVID-19 in 2020.

Top Insurance Companies in the World

In the company insurance game, there are a few key players. Insurance companies make a lot of money off of their clients in return for their safety and peace of mind.

You may choose to buy an insurance package from the following companies keeping in mind that since they are well known their services will not dissatisfy you.

The following companies are some of the leading life insurance, company insurance and auto insurance in the world, but are not mentioned in any specific order.

- AXA: you’ve probably heard this name at some point. AXA is one of the world’s leading insurance companies with their specialties being property and casualty insurance, life insurance, saving and asset management.

- MetLife: MetLife will offer you insurance for almost anything. Their company insurance products are categorized into the size and type of business so you can find the one best suited for your company. Insurance is also provided for individual employees and they also offer retirement plans.

- Zurich Insurance Group: if the name doesn’t give it away, Zurich Insurance Group is based in Switzerland, and was founded in 1872. Now, this insurance company is operating in more than 170 countries providing many types of company insurance to businesses.

- AllState: AllState insurance company provides a wide variety of company insurance packages. Their products are suitable for almost any type of business and they work in creating business policies specially for your business’s needs.

- Munich Re Group: although their home market in Germany, Munich Re Group operates in 30 countries especially in Asia and Europe. T The different types of insurance they offer range from life reinsurance, liability business, property-casualty business, accident insurance and fire reinsurance.

Now let’s turn back to you, take a look at your business and think about the type of insurance you have, and the type of insurance you need. This article may have opened your eyes to some aspects that you’ve never considered before.

Or maybe you don’t have any form of company insurance at all. In that case, this article should have enlightened you as to why this is often a very costly mistake.

To make sure that you’ve picked the right company insurance, look at your business operations and picture the worst possible scenario and go from there.

Examine that damages that could be done to any aspect of your business and look at what you can do to stop that from happening. Whether you’re running a small shop, a large corporation or a humble firm, company insurance will be needed for the long term success of your business.